Working With Us

To get started, we recommend scheduling a 30-minute new client introductory call. This gives us the opportunity to get to know each other and determine whether Rivet is the right fit for your tax needs. If you have a preexisting relationship with us, this call won't be necessary.

If you decide to move forward, here's what you'll need to do:

Setup your client portal account. You'll use this to upload documents, complete your online tax organizer, sign your tax returns, pay invoices, and even chat with us directly.

Sign your Client Engagement Letter. This agreement explains the terms of our service and outlines the rights and responsibilities of both parties.

Pay your annual retainer fee. This fee secures our work for the year. Our retainer is $450, and will be applied against your final invoice.

See our Services page for more information about what we offer and how to sign up.

There are two ways to get us your tax documents:

- Upload through your online client portal. Get your records to us instantly by using your client portal on any web browser.

- Upload your documents using your phone. If you download the TaxDome Client Portal app on your Smartphone, you'll have access to all the same upload features as your online portal. By clicking "Upload documents," the app will access your camera and allow you to scan the document straight to the app.

Rivet prides itself on being paperless, but we understand that’s easier said than done. If you’re having trouble uploading your documents, please contact us and we will provide additional options.

For security reasons, we don’t accept documents over email.

Rivet takes data protection seriously. By law, all tax providers are required to have a Written Information Security Plan (WISP) detailing the measures in place to protect client data. A copy of our full WISP is available upon request.

Here are a few of the key items:

All of our software uses 256-bit encryption, which is the most secure encryption algorithm available today and is widely used by financial institutions and government agencies.

All members of our team use two-factor authentication to access your sensitive data. Two-factor authentication means that every time we login to view your digital information, we're required to provide two forms of identification. For example, a password and a security code sent to our phones.

Your online data is stored on AWS servers and are backed up daily. The servers are based in the US, and are safeguarded by multiple layers of physical security.

Keeping your data safe is our top priority, but we need your help. We ask that you not use email or text to send us their sensitive information as these channels are the most vulnerable to attacks.

No. Unless there are extenuating circumstances, all our services are electronic. By law, tax providers are required to file electronically unless taxpayers opt out. We don't believe it's in our clients best interest to opt out, however, due to the security concerns posed by paper returns.

Reports of postal theft have increased by more than 80% since 2019. Sending sensitive data or checks by mail exposes taxpayers to unnecessary risk. Further, paper-filed returns take longer to process by taxing agencies, leading to unnecessary tax notices that are often time consuming and costly to resolve.

In general, returns are usually finished within 1-2 weeks of receiving complete records, but we may take longer if your return requires more care. While we try to be as efficient as possible, we value quality over expediency.

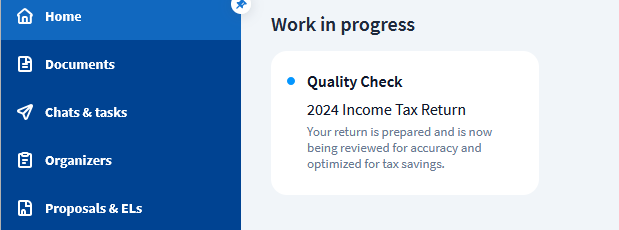

You can track the progress of your return directly from your client portal.

Once you've signed the e-file authorization forms and paid our last invoice, we will electronically file your return on your behalf. It generally takes 24-48 hours for the taxing agency to accept the transmission. An e-file acknowledgement letter will be saved to your client account so you have confirmation your return is finished.

Taxpayers are always responsible for the accuracy of their returns, even if they hire a tax professional to prepare them. As a Rivet client, we expect you to:

Provide complete and accurate information in a timely fashion.

Review your tax return before signing it.

Retain your tax records for a minimum of 3 years.

Be respectful to Rivet personnel and contractors.

With these standards in mind, we understand that mistakes happen. If an error or omission has occurred on your return, please bring it to our attention so we can work together to resolve it.

Our Services

We generally bill our services by the hour. In some cases, however, there are two additional factors we consider as well: Complexity and value.

Complexity is the skill and expertise needed to accurately prepare your tax filings. A 1031 Exchange may not take us long, but it does require a level of proficiency in the tax code that we're able to offer because of our years of experience and training.

Value is the application of our expertise to your unique tax situation. As we get to know you, we actively look for ways to save you money, minimize risk, and remove the stress of tax time from your life. This isn't always reflected in significant time spent on one particular project, but is often the result of an accumulation of knowledge about your individual needs.

Our invoices are itemized to reflect the work performed, and we are happy to provide additional information if desired. Please reference our Services page to see our median rates.

Income tax filings include all of the following:

- Federal and state income tax preparation and submission

- Digital tax organizer and document upload tools

- Federal and state tax extensions

- Estimated tax payment calculations

- Research to verify eligibility for possible write-offs

Rivet is committed to filing accurate and reliable returns that not only get you the best possible tax savings, but minimize audit risk as well. Your peace of mind is our top priority.

Maintenance calls are 15 minute appointments that can be scheduled through your client portal at no extra cost. We recommend using these calls to ask us questions or share life updates - anything that will help us monitor for tax planning opportunities.

Maintenance chats are also available through your client portal, and can be sent anytime. This is a great option for quick communications or time sensitive questions. Chats are typically responded to within 1-2 business days.

Additional work arising from maintenance communication - such as tax projections or technical analysis - will have to be addressed through a formal tax consultation. We will alert you if a topic exceeds the scope of this feature, and will provide you with next steps.

Only 5 maintenance calls are included in your annual Compliance package, but chats are unlimited.

To book a 1 hour consulting call, see the Services page of our website.

Your client portal is a one-stop-shop for all your tax needs. All the features available on the website are accessible from inside the app as well, you can:

- Sign your engagement letter

- Upload your tax documents (simply snap a photo)

- Fill out your digital organizer

- Track the status of your return in real time

- View your tax return and tax records

- Chat with us

- Book appointments

- See tax alerts and other important news

To download the app, lookup "Tax Dome Client Portal" in your app store. Login using the same credentials you made with your online account.

If you fall victim to identity theft, our Identity Theft Coverage will restore and secure your private data. The coverage will also provide ongoing monitoring for a year beyond the initial incident to ensure the threat is resolved. All active Rivet clients are entitled to this coverage, regardless of where the data breach happens.

For tax years covered by a Rivet engagement letter, we will provide notice resolution and audit support.

Rivet has partnered with a third party provider, Protection Plus, to resolve any federal or state income tax notices you receive. Protection Plus has a team of CPAs, EAs, and Attorneys who specialize in representing taxpayers, and will provide up to $1 million in services to resolve the issue.

All actively engaged Rivet clients are eligible for this service. To get the most effective support, Rivet must be provided a copy of the tax notice within 10 days of its receipt. This program provides access to professionals trained to advocate on your behalf, it does not cover the penalties, interest, or additional taxes you may owe.

Our consulting sessions vary greatly from person to person - there is no "one size fits all" approach.

When you schedule a consulting appointment, you will be prompted to answer a series of general questions about what you want to discuss. The more detail you provide, the better. We will use these answers to prepare for our meeting. If it seems the conversation would be more fruitful with additional services, we will recommend those to you before our call.

For instance, we may suggest:

- Tax projections comparing different scenarios related to your inquiry

- In-depth review of a deduction you're claiming, such as depreciation, to make sure it's optimized

- Reasonable compensation analysis for S-Corporation owners

Work performed in connection to the consultation will be billed separately, and we will notify you prior to performing any work of the added cost.

General Tax Questions

The biggest difference between Certified Public Accountants (CPAs) and Enrolled Agents (EAs) is scope. CPAs have a broad range of knowledge in areas of audit, tax, and accounting. Conversely, EAs specialize exclusively in US income taxes, with special focus on taxpayer representation.

The Enrolled Agent (EA) license is the highest tax credential awarded by the IRS. EAs have unlimited practice rights in all 50 states and can represent taxpayers in tax court - a privilege shared only with CPAs and Attorneys.

The Certified Public Accountant (CPA) license is awarded by each state’s Board of Accountancy. Most CPAs will choose to specialize in a specific area after passing, but their broad training makes them well suited to handle multi-faceted accounting needs.

Taxes are due April 15th, regardless of whether an extension is filed, but that doesn’t mean you need to know your exact balance at that time. As a general rule, failure to pay penalties are avoidable if you simply pay in as much as you owed the year before. We’ll help you figure out the right amount when we file your extension.

Not necessarily. Most states allow individuals to run and operate their businesses under their own name and social security number without registering for an LLC. This is called being a “sole proprietorship.” In many cases, operating as a sole proprietorship is the best option. It can shield you from state Franchise fees and higher tax preparation bills.

There are reasons to consider an LLC. It can be a mechanism to protect your personal assets, and there are tax advantages in certain cases. Rivet can help you weigh the tax advantages and disadvantages in your unique situation. You may want to consult with an attorney to determine the merits of an LLC from a liability standpoint.

Your tax bracket is determined by your filing status and taxable income. Your taxable income is your total income minus adjustments and deductions.

On your Form 1040, your taxable income is listed on line 15.

When it comes to understanding your tax rate, there are two terms to be familiar with: Marginal and effective.

Your marginal bracket is the highest tax rate your income is subject to. Not all of your income will be taxed at this rate. The US operates on a graduated tax system, which means your tax rates incrementally increase with your income.

A single person who earns a million dollars will pay 10% tax on their first $11k - just like the rest of us. The next $34k is taxed at 12%, and so on. All of their earnings over $600k are taxed at 37% - the top marginal bracket.

Your effective tax rate is the average tax rate you pay across your brackets. See our Shortcuts page for a quick link to the most current tax rates.

BOI stands for Beneficial Ownership Information. A “beneficial owner” is anyone who controls or owns more than 25% of the company. A new congressional law requires businesses to file a BOI report with the Financial Crimes Enforcement Network (FinCEN), disclosing their ownership information. This takes effect in 2024, and applies to most LLCs and corporations – sole proprietors are exempt.

The report is due January 1st, and failure to file the report can result in steep penalties. Rivet does not assist in filing these reports, and is not liable for a business's failure to do so.